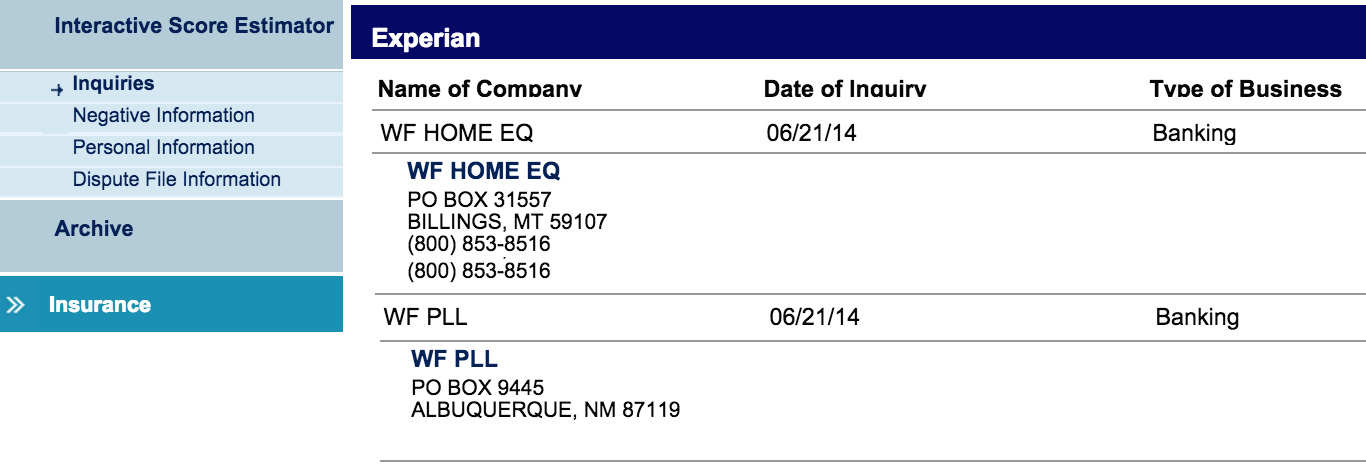

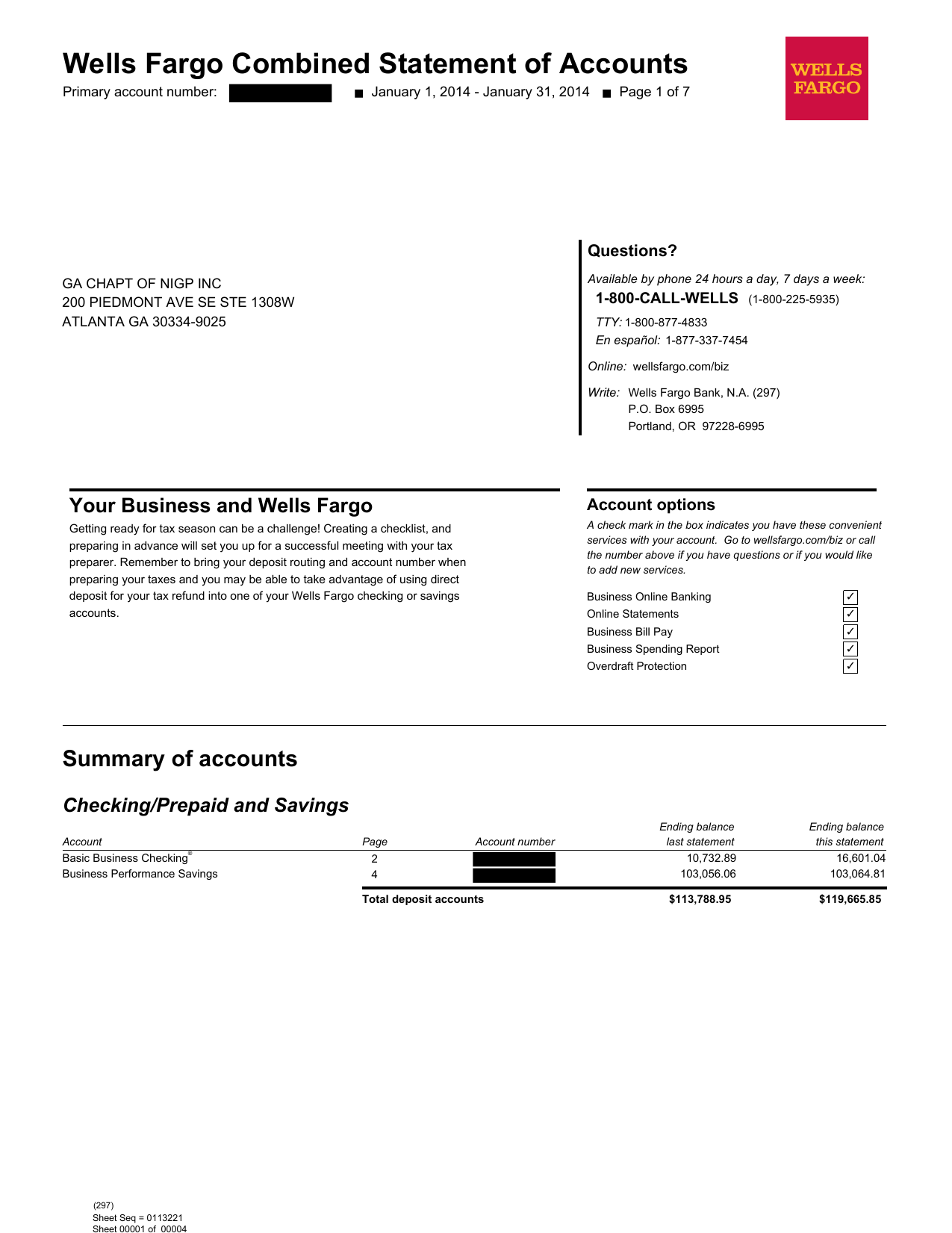

The bank also made deceptive claims as to the availability of waivers for a monthly service fee. Customers affected by these account freezes were unable to access any of their money in accounts at the bank for an average of at least two weeks. Unlawfully froze consumer accounts and mispresented fee waivers: The bank froze more than 1 million consumer accounts based on a faulty automated filter’s determination that there may have been a fraudulent deposit, even when it could have taken other actions that would have not harmed customers.As early as 2015, the CFPB, as well as other federal regulators, including the Federal Reserve, began cautioning financial institutions against this practice, known as authorized positive fees.

This is an important initial step for accountability and long-term reform of this repeat offender.” “The CFPB is ordering Wells Fargo to refund billions of dollars to consumers across the country. “Wells Fargo’s rinse-repeat cycle of violating the law has harmed millions of American families,” said CFPB Director Rohit Chopra. Under the terms of the order, Wells Fargo will pay redress to the over 16 million affected consumer accounts, and pay a $1.7 billion fine, which will go to the CFPB's Civil Penalty Fund, where it will be used to provide relief to victims of consumer financial law violations. Wells Fargo also charged consumers unlawful surprise overdraft fees and applied other incorrect charges to checking and savings accounts. Consumers were illegally assessed fees and interest charges on auto and mortgage loans, had their cars wrongly repossessed, and had payments to auto and mortgage loans misapplied by the bank. The bank’s illegal conduct led to billions of dollars in financial harm to its customers and, for thousands of customers, the loss of their vehicles and homes. – The Consumer Financial Protection Bureau (CFPB) is ordering Wells Fargo Bank to pay more than $2 billion in redress to consumers and a $1.7 billion civil penalty for legal violations across several of its largest product lines.

0 kommentar(er)

0 kommentar(er)